Author: Braze Team

Financial services brands are making gains in employing marketing best practices to achieve impressive results. They’re leveraging advanced segmentation, using zero-party and first-party data for campaign planning, and, more than any other sector, they regularly collaborate across the organization on customer engagement initiatives.

Here are a few of the top 2024 financial services marketing trends that surfaced from our fourth-annual Global Customer Engagement Review (CER).

Let’s dive into the findings and review how FinServ marketers can get and stay ahead.

The Top 5 Key Trends for Financial Services Marketers

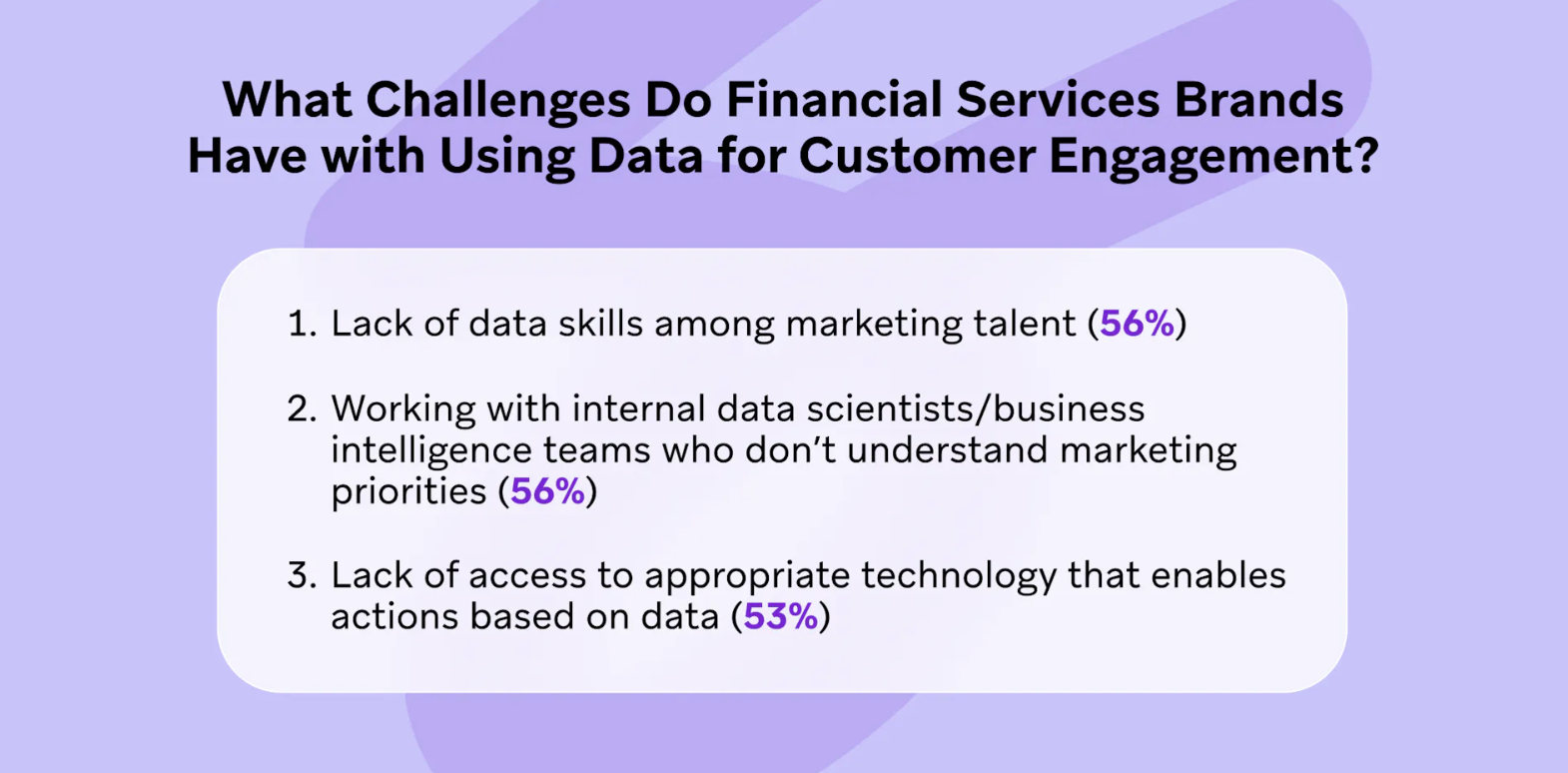

1. Financial services organizations need the right tools and skills to better leverage data for customer engagement.

Financial services companies stand to benefit from sharing key marketing priorities with data scientists and business intelligence (BI) teams, as they’re in the best position to help marketers apply data for more effective customer engagement. At the same time, it’s important to upskill marketers so they can work more independently without having to rely on outside teams. Equipping marketers with tools capable of automating data analysis and the next best action helps close these skill and knowledge gaps across the organization.

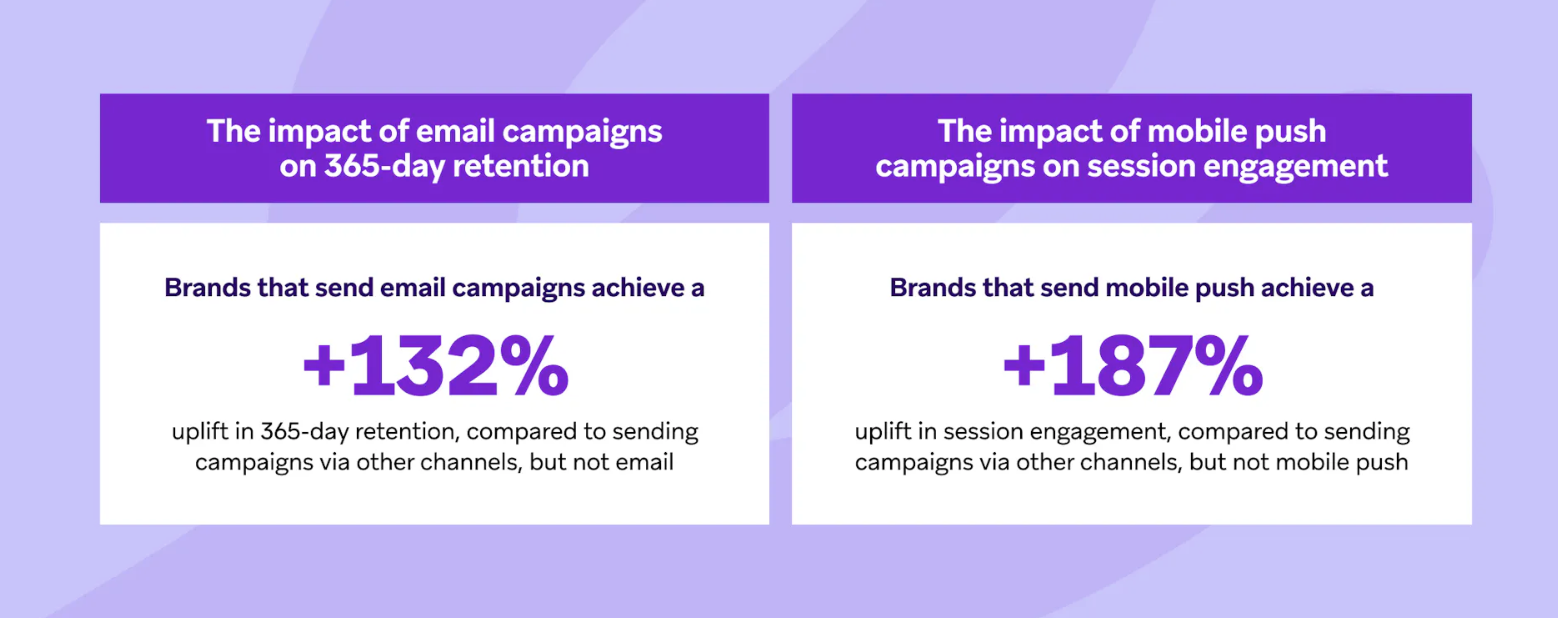

2. Leveraging the right channels can help FinServ brands drive session engagement and retention.

Braze data reveals that marketers using out-of-product channels like email and push notifications can see major uplift in session engagement and retention.

Cross-channel campaigns that leverage multiple in-product and out-of-product channels are also highly effective for engaging and retaining FinServ customers.

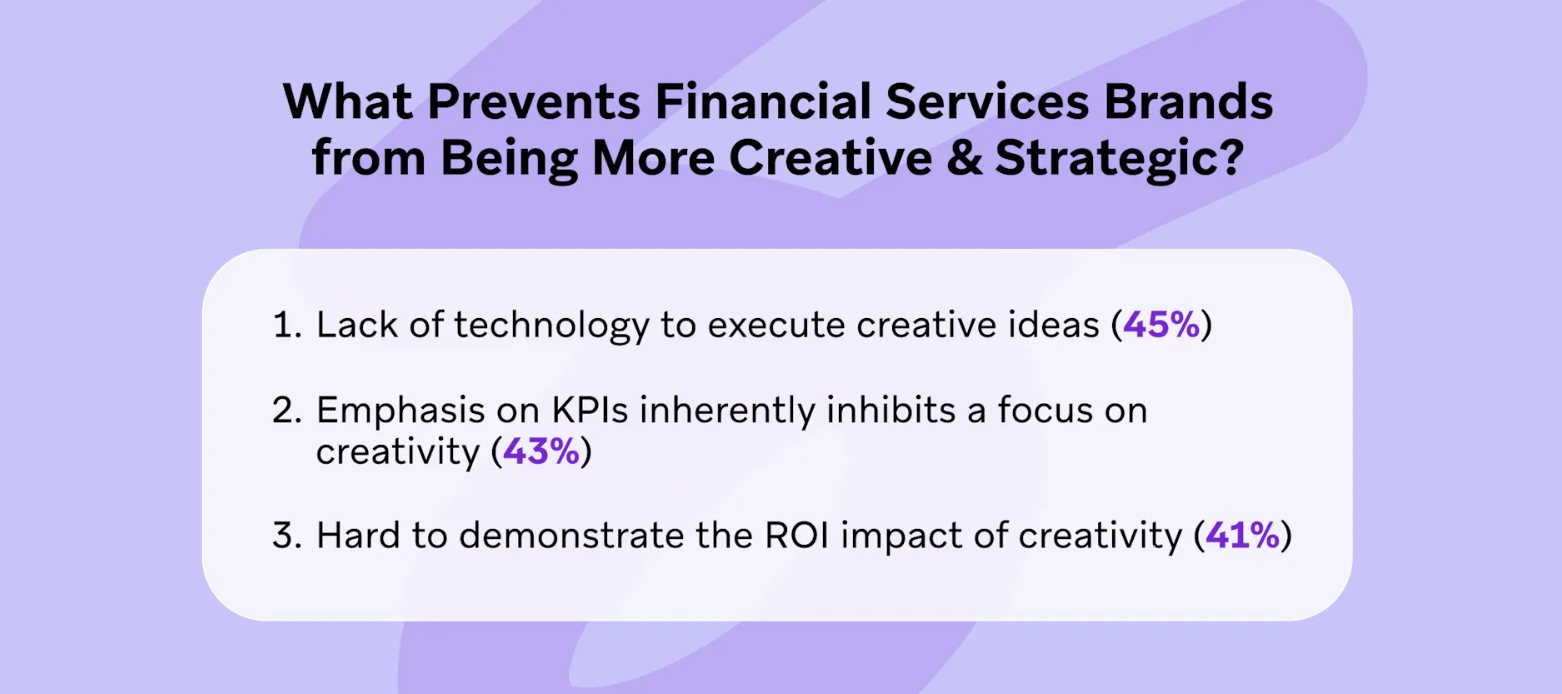

3. Lacking the technology to bring their team’s ideas to life is the #1 challenge for FinServ marketers looking to be more creative and strategic.

More than four in ten FinServ marketers say their current toolset stands in the way of executing creative ideas. Other top roadblocks include a focus on KPIs over creativity and an inability to demonstrate the ROI of creativity.

4. Financial services organizations are leading the way when it comes to dynamic, data-driven segmentation.

Historically, financial service organizations haven’t led the way in customer engagement, but that’s changing. The industry is putting stronger strategies in place this year—and beyond.

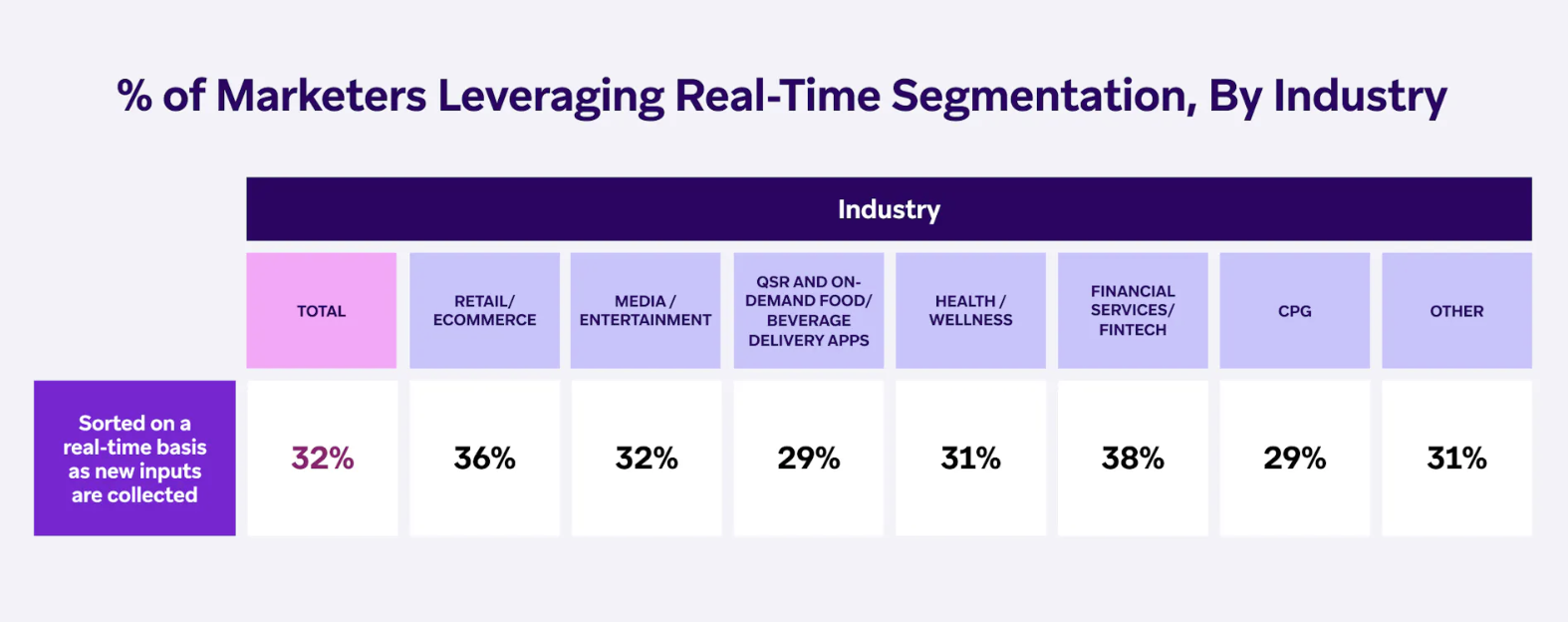

From a technology perspective, financial services brands excel at customer segmentation, particularly at leveraging real-time segmentation based on up-to-the-moment information about customer behavior, interests, transactions, and interactions—38% of surveyed marketers in this sector are operating at the top level for segmentation, a higher share than any other vertical.

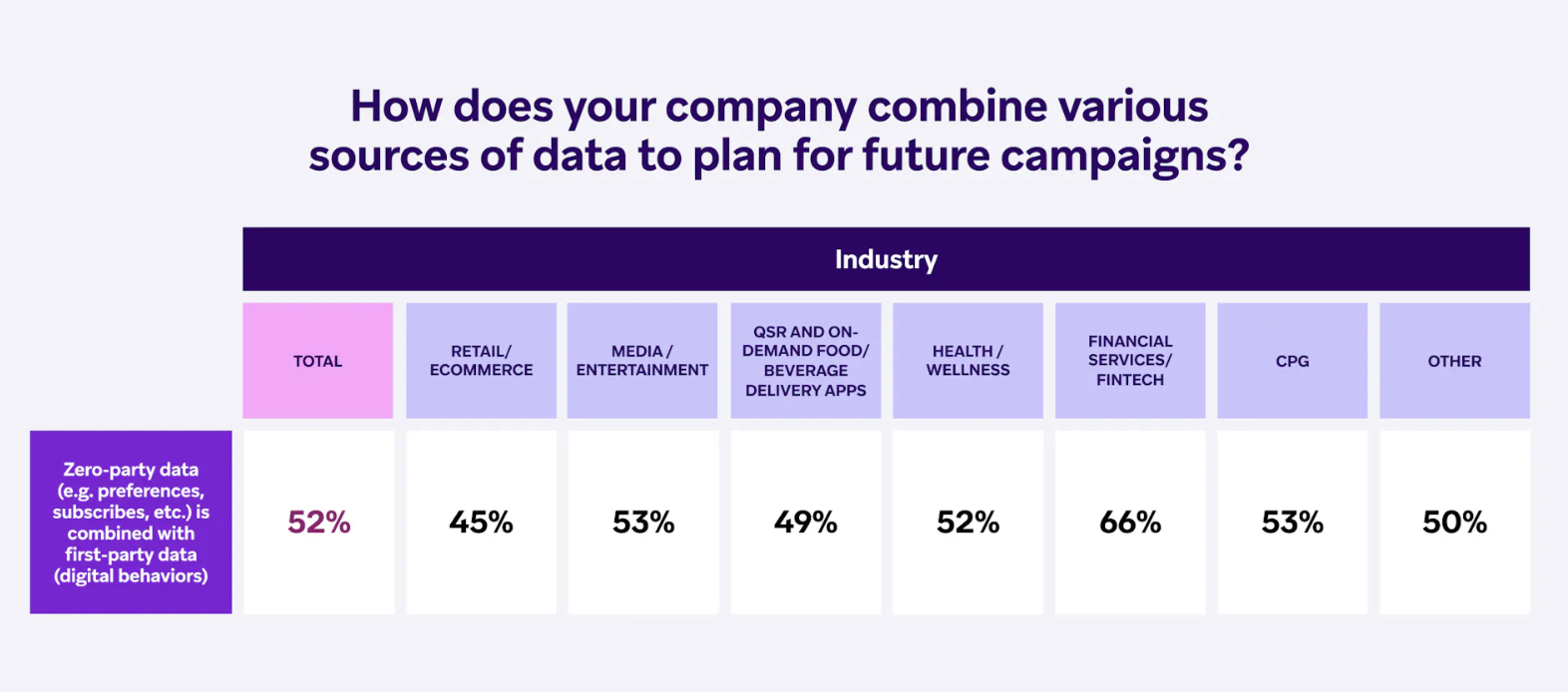

FinServ companies are also at the forefront of utilizing various data sources to strategize future campaigns. Marketers in this industry lead all other sectors by 13 percentage points when it comes to using zero- and first-party data for campaign planning.

5. Despite skepticism, there are big opportunities for FinServ brands to use AI.

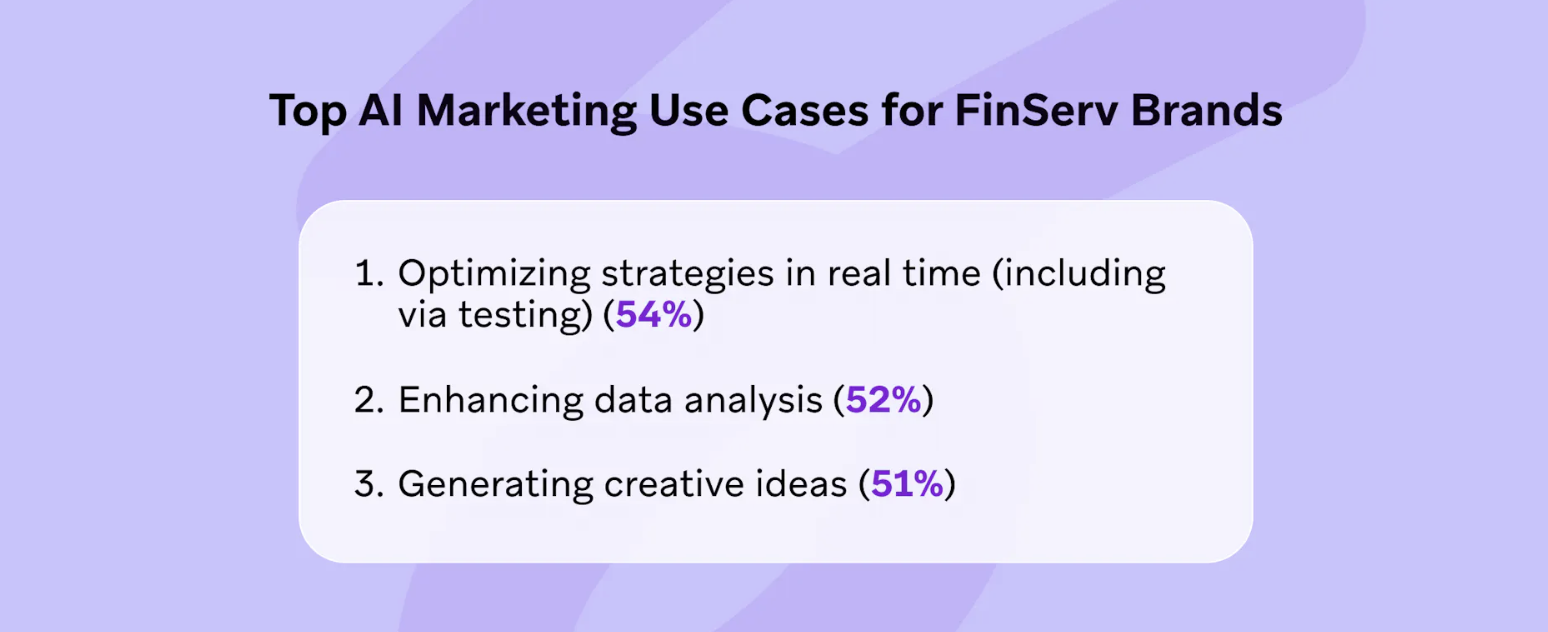

Our research shows that 25% of marketing executives in the FinServ industry have an unfavorable view of AI, making this sector less receptive to AI compared to most others. However, to stay competitive and innovative, many FinServ brands are still looking to invest in AI technologies. These brands are increasingly planning to use AI for real-time optimization, data insights, and creative ideation, recognizing the potential of these capabilities to enhance customer engagement and operational efficiency in a rapidly evolving market.

Final Thoughts

FinServ companies recognize the importance of customer engagement, to the tune of tremendous growth over the past year. Going forward, marketers must prioritize technology that provides deep insight and enables goals for personalization and cultivating deeper customer relationships.

Want to learn about how FinServ brands can leverage customer engagement to drive success? Check out our Financial Services Mini-Guide for actionable strategies to drive growth.

About the Study

These findings are part of our broader fourth-annual Global Customer Engagement Review, which draws on the following sources:

- Market research featuring 1,900 VP+ marketing decision-makers across 14 countries in three global regions.

- An analysis of Braze proprietary data, including 9 billion global users and nearly 1,000 Braze customers in 50+ countries, via our leading customer engagement platform.

- In-depth interviews with marketing leaders from best-in-class brands in five industries across three regions.